With ever increasing government spending pressures to address societal and development goals and the need to grow the economy, the role of fiscal policy remains immeasurable in emerging countries such as South Africa. We seek to answer the following three broad questions. What are the macroeconomic effects of government spending and tax policy? What are the implications of the interaction of fiscal policy with monetary policy on the economy? How can fiscal policy act as an effective shock-absorber to global shocks? We seek to answer these questions using a data-driven approach.

Author: Tumisang Loate, Nicola Viegi

Publish Date: 19-01-2024

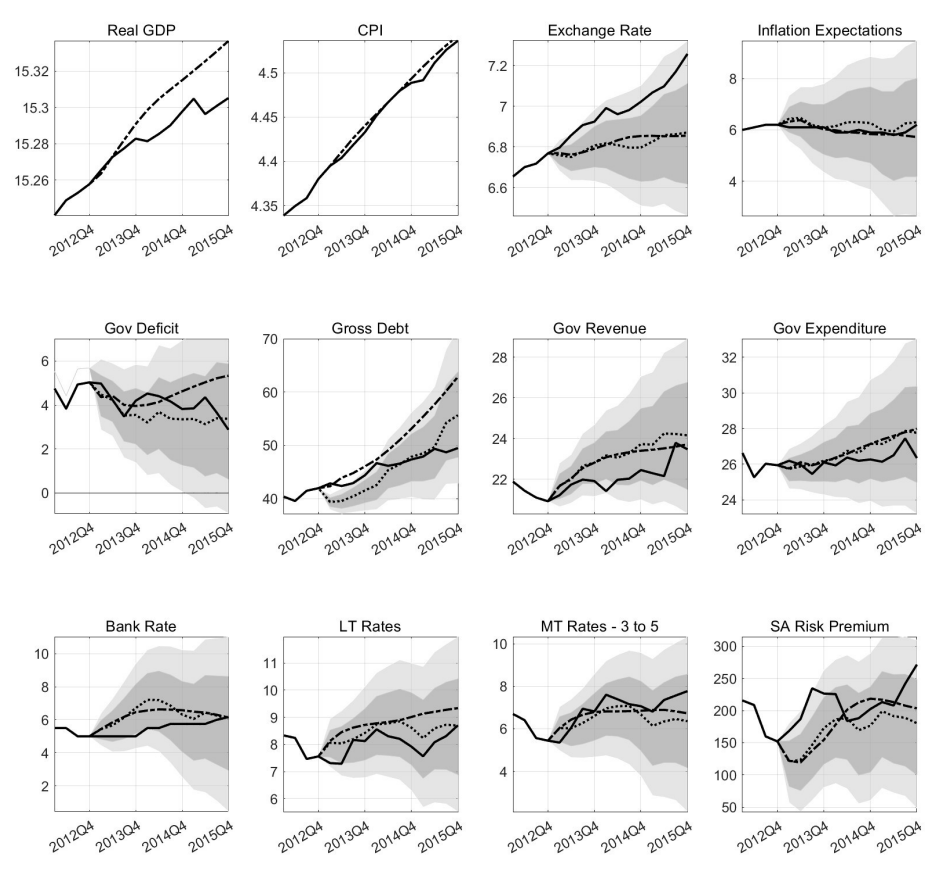

Historical relationships between the macro-fiscal variables indicate a much higher economic growth in South Africa. We explore the role of both fiscal and monetray policy and find little evidence that the realised low economic growth can be rationed by the two policies, especially monetary policy.

SARB Working Paper

Author: Tumisang Loate , Romain Houssa and Nicola

Publish Date: 10-2021

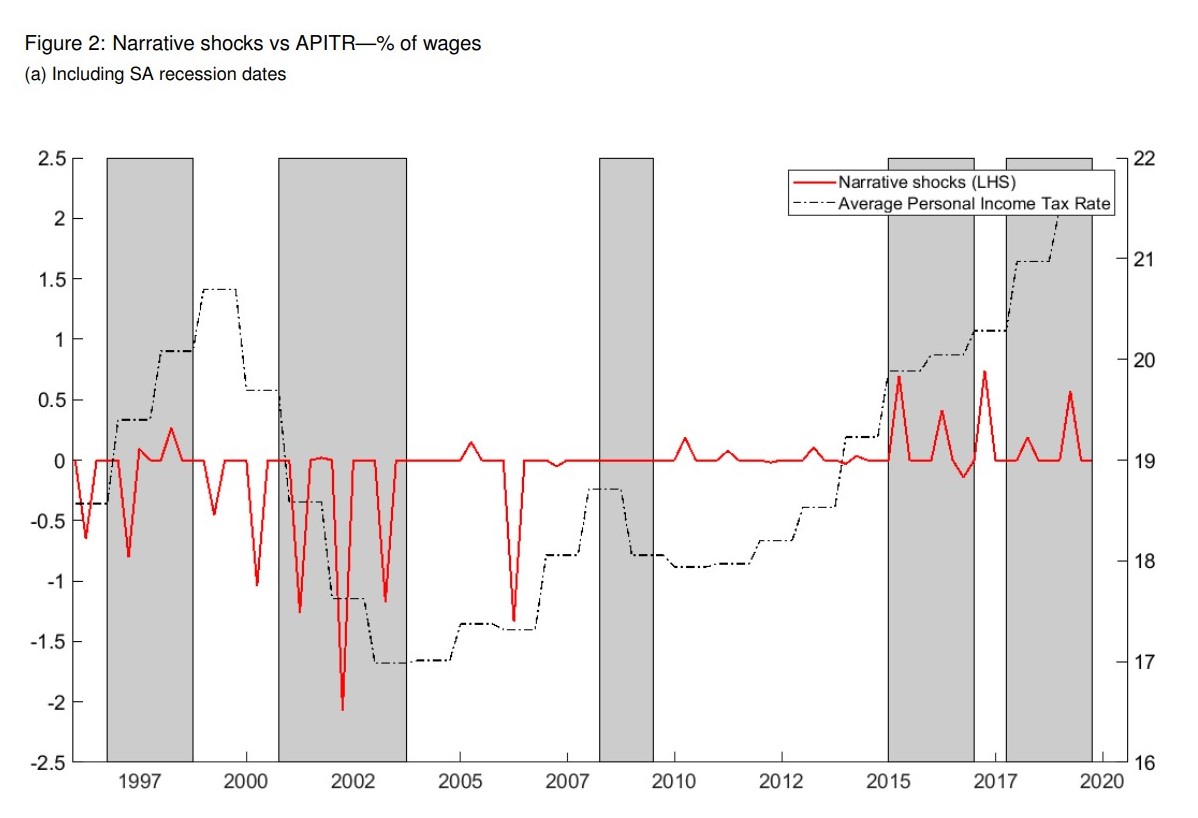

Evidence using narratively identified personal income tax shocks indicate that the observed expansionary effect of tax cuts is mainly driven by changes in marginal tax rates. However, these tax changes are not tax neutral.

UNIWIDER Working Paper