Research in this section focuses on understanding and investigating the role of bank regulation, particularly (macro) prudential in influencing banking sector behaviour

Author X. Sibande, D. Nxumalo, K. Mncube, S. Koch, N. Viegi.

Publish Date

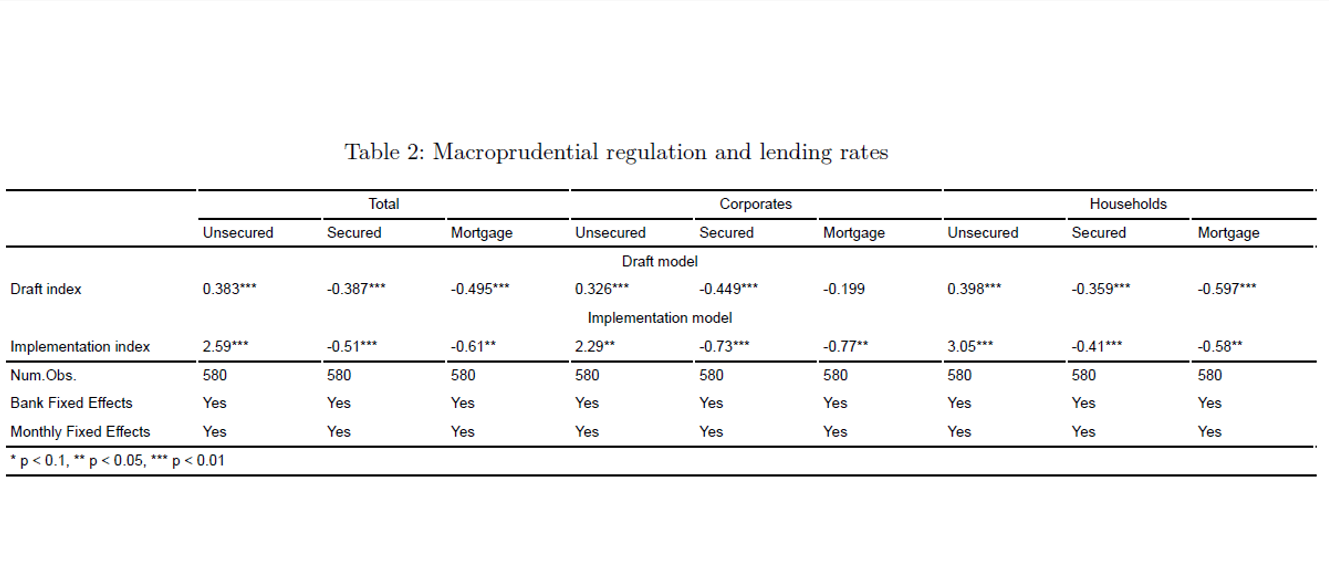

This study estimates and contrasts the impact of macroprudential and financial inclusion policies. The results suggest that macroprudential policy is working as intended as it is associated with increases in interest rates on unsecured lending rates, decreases in short-term secured and mortgage lending rates.

Author Keaoleboga Mncube

Publish Date

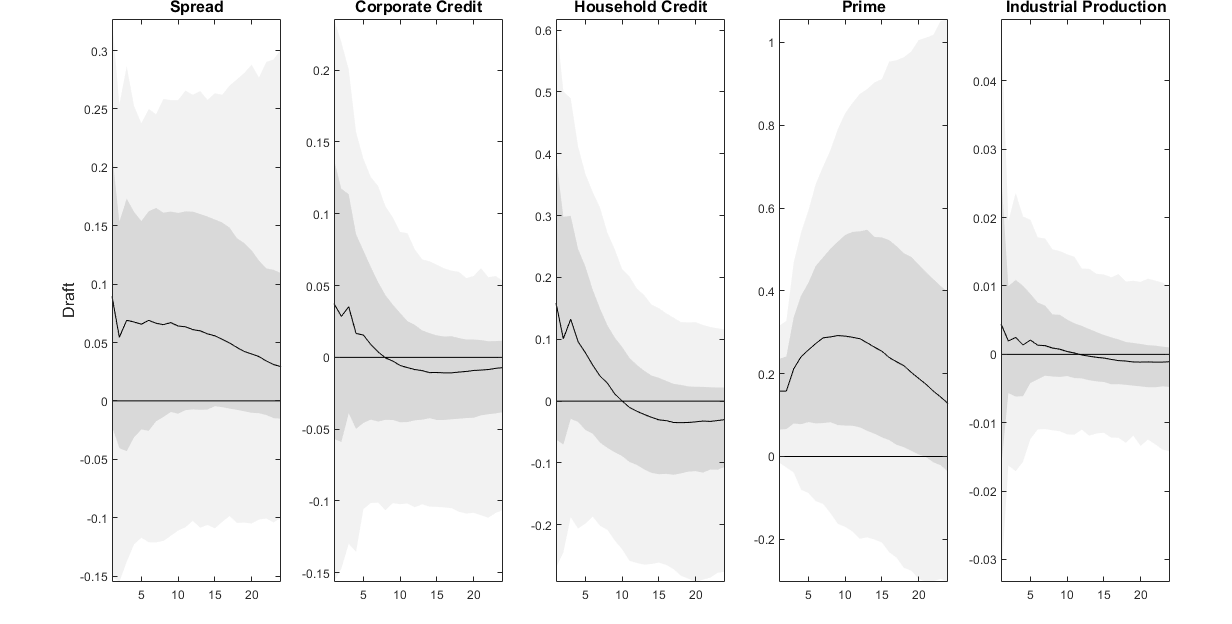

This paper investigates and estimates the macroeconomic effects of regulatory changes in the South African banking industry, by introducing narrative series capturing regulatory changes. The estimations are perfomed in a Bayesian Vector Autoregression (BVAR(X)) and Local Projections-Instrumental Variables (LP-IV) settings. The results show both a contraction and increase in credit extension following regulatory changes.

Author Keaoleboga Mncube

Publish Date

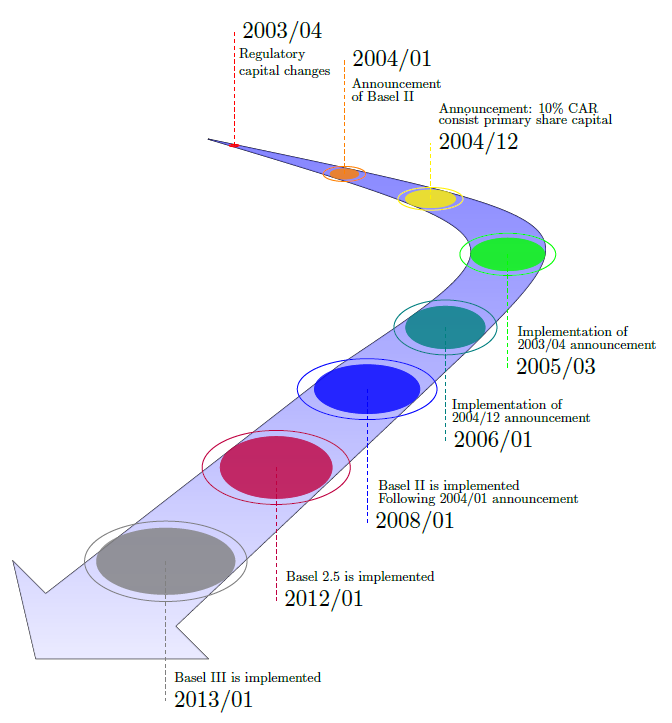

This figure shows a timeline of major macroprudential regulatory changes in the South African banking industry.